private reit tax advantages

One of the REIT Advantages and Disadvantages comes from the fact that the underlying asset in REITs is real estate. When the underlying assets value increases your.

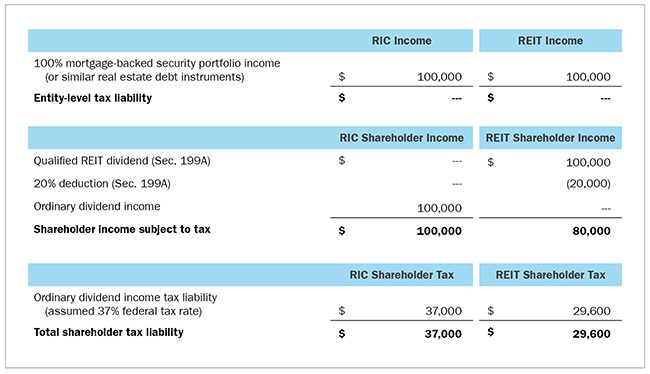

1940 Act Reits Vs Rics The Qualified Business Income Deduction Cohen Company

Find out why almost half of American households invest in REITs.

. The City Market of Los Angeles was founded in 1909 as the central produce distribution market for the City of Los Angeles. The best reason to invest in commercial over residential. And because private REITs are LLCs this depreciation can be passed through to individual investors.

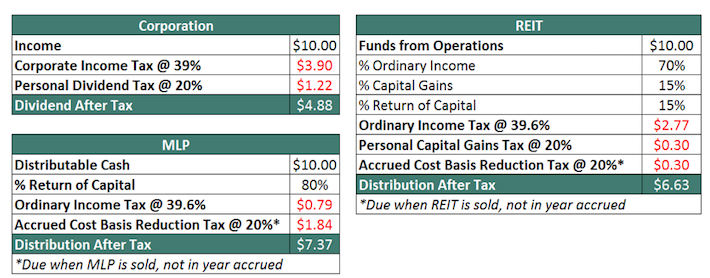

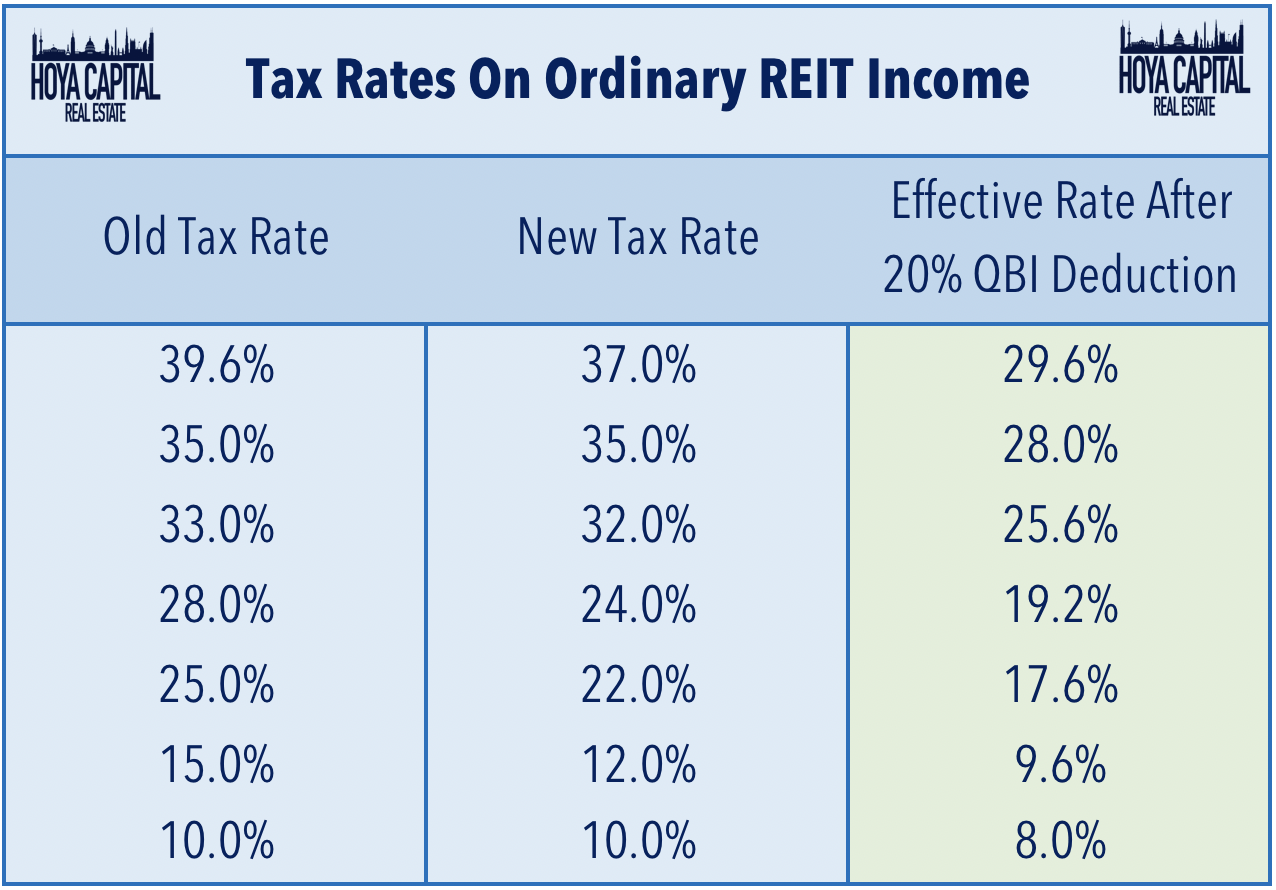

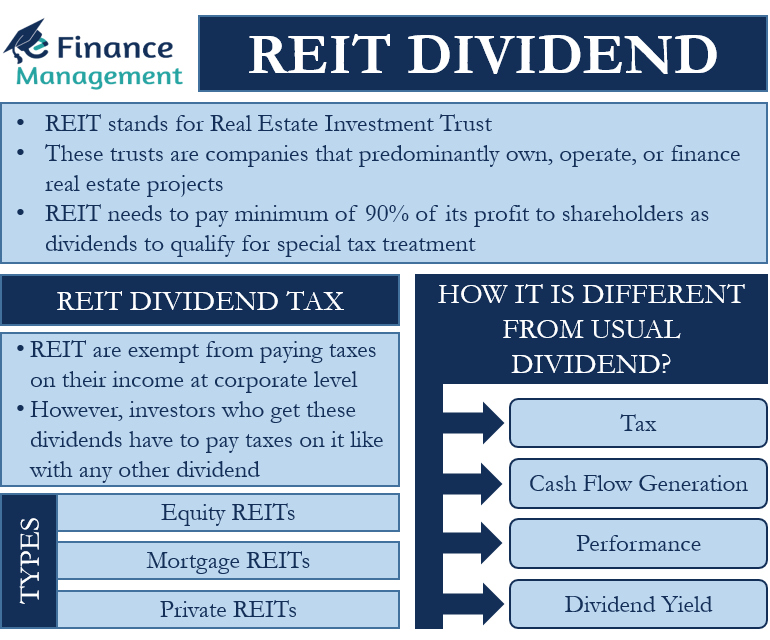

This article provides a brief overview of REIT requirements and the use of private REITs as potentially tax-advantageous vehicles for private investment funds. A wide variety of investor types can recognize REIT benefits. Tax benefits of REITs Current federal tax provisions allow for a 20 deduction on pass-through income through the end of 2025.

Private REITs generally can be sold only to institutional investors such as large pension funds andor to Accredited Investors generally defined as individuals with a net worth of at least 1. One of real estates greatest tax benefits is depreciation. Individual REIT shareholders can deduct 20 of.

REIT tax advantages like QBI and passthrough taxation mean a higher return on investment. Up to 25 cash back Here are some of the pros of buying commercial real estate over residential property. Search for other Tax Return Preparation in Tujunga on The Real Yellow.

Another advantage of REITs is that they must annually distribute almost all of their rental and capital income as dividends to shareholders which results in some favorable tax. Get reviews hours directions coupons and more for Reit Tax Service at 7636 Foothill Blvd Tujunga CA 91042. Principal and interest payments on any borrowings will reduce the amount of funds available for distribution or investment in additional real estate assets.

6 REIT Tax Advantages Here are the top tax benefits investors earn when investing in REITs. Foreign Investors REITs function like a blocker. The list below summarizes a few of the main advantages of starting a private REIT.

After-tax yield is reflective of the current tax year which does not take into account other taxes that may be owed on an investment in a REIT when the investor redeems his or her shares. REIT investors can deduct up to 20 of ordinary dividends before. A Private Real Estate Investment Trust or REIT is a tax-efficient vehicle that gives people exposure to a diversified portfolio of income producing properties.

The District of Columbias Mayor Muriel Bowser proposed a 20 million Workforce Housing Fund to help subsidize housing for teachers police officers janitors and social. After-tax yield is reflective of the current tax year which does not take into account other taxes that may be owed on an investment in a REIT when the investor redeems his or her shares. As the company expanded its operations from the central produce.

The Pass-Through Deduction The pass-through deduction allows REIT investors to. The REIT shareholders remit tax on ordinary and capital gain dividend income at their respective tax rates.

The Definitive Breakdown Of Reits Vs Private Reits

Advantages And Disadvantages Of Investing In Reits

Should You Invest In A Reit Or A Private Placement Next Level Income

Real Estate Investing 101 White Coat Investor

How To Value Reits In 2022 Real World Examples

What Is A Reit Real Estate Investment Trusts Explained

/DDM_INV_REIT_final-c25e927cfd044ee79c56a6ddf1a6a696.jpg)

Real Estate Investment Trust Reit How They Work And How To Invest

Benefits Of Establishing Private Reit Siouxfalls Business

A Complete Guide To Reit Taxes The Ascent By Motley Fool

Reit Tax Advantages Streitwise

Sec 199a And Subchapter M Rics Vs Reits

Real Estate Investment Trusts Reits What Are Reits

The Taxman Cometh Reit Tax Myths Seeking Alpha

The Definitive Breakdown Of Reits Vs Private Reits Aspen Funds

Reit Dividend All You Need To Know

Real Estate Investment Trusts Reits And The Foreign Investment In Real Property Tax Act Firpta Overview And Recent Tax Revisions Everycrsreport Com

What Is A Reit Definition Types And Investing Tips

Reits Explained Types Alternatives Pros Cons Arrived Homes Learning Center Start Investing In Rental Properties

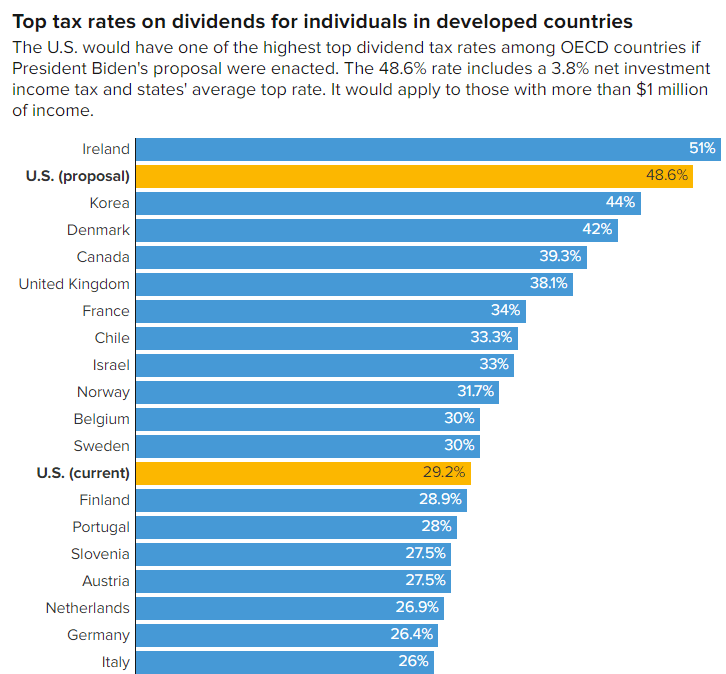

Biden S Tax Proposal Impact On Stocks And How To Use Reits For Tax Advantages Seeking Alpha